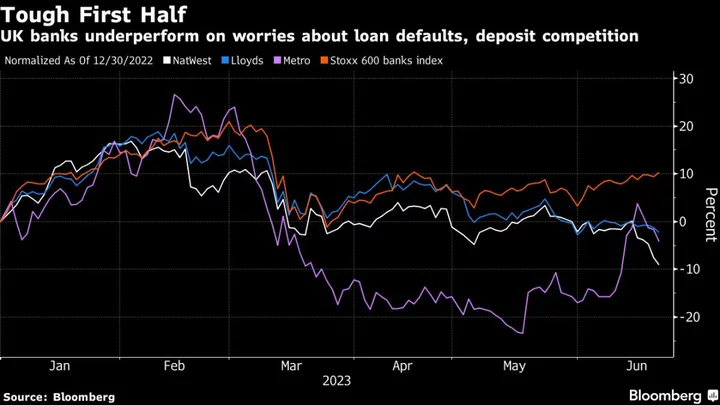

British lenders are facing a “pain game” as interest rate hikes hurt the outlook for both loans and deposits, analysts at Exane BNP Paribas warned before a hot inflation number on Wednesday sent UK bond yields even higher.

Exane’s Guy Stebbings downgraded NatWest Group Plc to underperform from neutral, becoming only the second analyst tracked by Bloomberg to have a sell equivalent rating. He cut NatWest’s FTSE 100 rival Lloyds Banking Group Plc to neutral and lowered smaller player Metro Bank Holdings Plc to underperform from neutral.

“Back in the danger zone,” Stebbings said in a note to clients published after Tuesday’s close of trading. “Higher rates lift bank earnings but at a certain level this equation breaks down.” He added that “we are well past this point.”

NatWest fell as much as 3.8% in London trading Wednesday while Lloyds was down as much as 3.1%. Metro Bank fell 3.4%.

Stebbings had been neutral on NatWest since Oct. 13, according to data compiled by Bloomberg. Since then, the stock rose 15% through Tuesday’s close.

The UK financial sector was also weighed down by data showing inflation in the country remained higher than expected for a fourth month. The numbers came ahead of another anticipated rate hike from the Bank of England on Thursday.

BOE Seen Boosting Pace of Hikes After Shock Inflation Reading

UK bank stocks have mostly fallen this year as lenders are expected to compete for deposits by offering savers higher rates of interest, while loan losses are forecast to mount as some consumers and businesses struggle to pay higher debt servicing costs.

--With assistance from Thyagaraju Adinarayan.