European Central Bank Vice President Luis de Guindos said that while another interest-rate increase next month is all but assured, the outcome of the following meeting remains unclear and will hinge on economic data arriving in the interim.

Guindos told Bloomberg TV on Wednesday that underlying inflation pressures may prove to be more stubborn than currently expected, with a strong summer tourist season likely to drive services costs higher.

“I think July is a fait accompli,” Guindos said in Sintra, Portugal, where the ECB is holding its annual retreat. “In September, I think that it’s open.”

The debate among ECB officials over when to pause their unprecedented run of rate hikes is heating up. Some have signaled that a good time to take stock could come after July’s move, though others — with an eye on sticky core inflation — say more tightening may be needed in the fall.

It’s unlikely that the ECB will be able to declare any time soon “with full confidence” that the peak in rates has been reached, President Christine Lagarde told attendees at Sintra Tuesday. She described a “second phase of the inflation process” where workers are seeking a “catch-up” in wages to recover lost income.

Politicians are wading into the discussion over hiking, too. Italian Prime Minister Giorgia Meloni warned that tightening may turn into “a cure that does more harm than good.”

Within the ECB, the strongest dovish remarks came from Portugal’s Mario Centeno, who cautioned that excessive tightening would be “essentially non-acceptable as a position.”

“We are not witnessing clear signs of second-round effects,” he told CNBC. “The economy is already taking a hit. And if the economy takes a hit, inflation will react”

The situation around consumer prices is starting to become clearer after Italy on Wednesday kicked off a slew of data, reporting a slowdown to 6.7% from a year ago in June — a 14-month low.

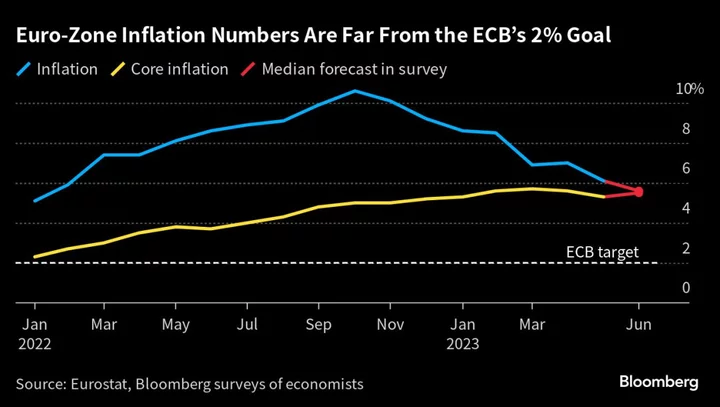

Overall, though, it’s looking like a mixed bag: While headline inflation — due Friday — is seen abating in the 20-nation euro zone, the underlying measure probably ticked higher. On the national level, statistical effects will quicken German price gains, but Spain’s reading may fall below the ECB’s 2% target for the first time in more than two years.

Most ECB officials in Sintra have focused on the lingering inflation dangers. Croatia’s Boris Vujcic said Wednesday that persistent price pressures may rule out a September pause. A day earlier, Belgium’s Pierre Wunsch insisted such a move can only happen if the core gauge dips for three more months — something analysts deem unlikely.

Malta’s Edward Scicluna was more circumspect, saying it may be preferable to hold borrowing costs at their peak for longer, rather than lift them ever higher. Estonia’s Madis Muller urged policymakers to carefully assess the economic impact of the action they’ve taken so far.

There are already signs of weakness in euro-zone growth, which may have stalled in June according to activity surveys released last week. Germany, the continent’s biggest economy, is struggling to exit a winter recession.

Guindos said Europe’s slowdown is likely to continue in the second half of 2023.

“I think some of these downside risks have started to materialize and are becoming much more visible,” he said. “The data that we are receiving about growth are not very good.”

--With assistance from Joao Lima, Alexander Weber, Jana Randow, Alessandra Migliaccio and Alessandro Speciale.

(Updates with Meloni, ECB officials starting in sixth paragraph.)